Last week, I shared with you some examples illustrating how the banks have tightened their policies on lending and how a few transactions in the wrong places can affect your ability to obtain a loan.

It seems like such a long time ago (and I guess it was), but when I was first started in real estate sales, you could obtain a ‘No Doc’ loan whereby you simply showed 100 points of I.D. and signed a Statutory Declaration to state that you could afford the repayments and with a clean credit rating, it was all approved without fuss.

Back in those days, they even provided loans at 103% of the value of the property so you didn’t even need a deposit!

Oh, how times have changed!

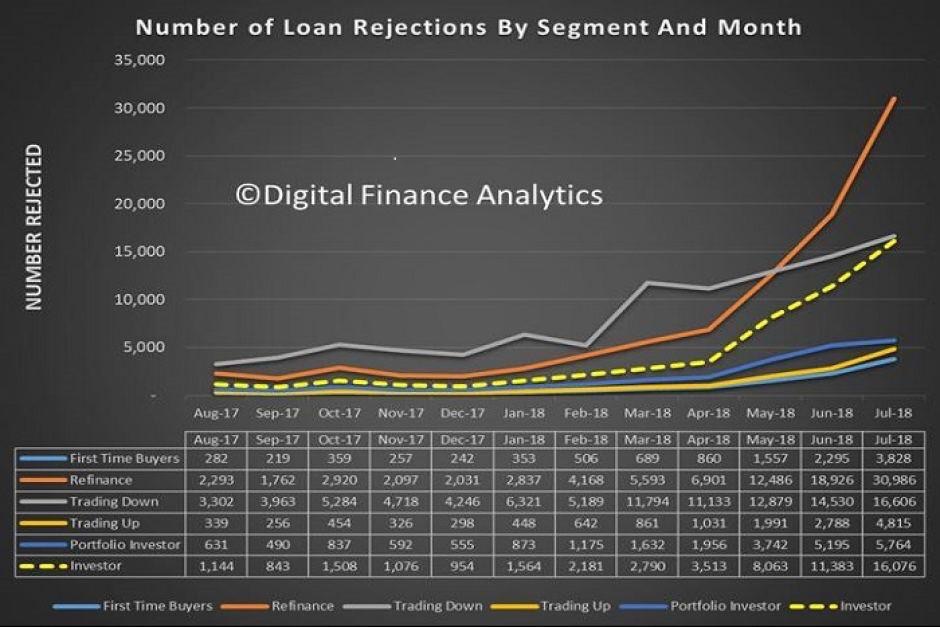

Only a few weeks ago, I received this graph showing the number of loans that have been declined over the past few months.

I must say that these numbers are quite startling…and what’s worse is that once the figures for the past 2-3 months are released, the numbers are expected to climb even further.

There are some really interesting aspects to these numbers…

Firstly, the loan declines of first home buyers are one of the lowest categories in a time where you’d think that those without a history of bank repayments would be met with the most scrutiny.

There’s probably no surprise that those applying for investment loans are finding it harder but the real surprise to me is that those looking to refinance are finding it very tough to do so.

Any ‘Interest Only’ loans need to be converted into ‘Principal & Interest’ loans based upon the recommendations from the Royal Commission and obviously many of these property owners have wanted to re-finance as a result.

Clearly, an increase from 1762 rejected applications for property owners looking to re-finance in September 2017 to 30,986 rejected applications for property owners looking to re-finance in July 2018 means that things have changed dramatically in a very short period of time.

There’s no question that if some of these property owners aren’t able to refinance their existing mortgage and can’t afford the extra amounts to pay off the principal as well as the interest component, they will likely be selling now or in the short-term future.

The other huge surprise in these figures is the amount of home owners that are looking to ‘trade down’ (or downsize) their homes…but have had their loan applications rejected!

From 3,302 loans declined in August 2017 to 16,606 loans declined in July 2018, this is a huge change.

On the surface, you’d think that a ‘downsize’ would mean that some of these home owners are seeking to ‘downsize’ their mortgage…which you would assume would mean less risk for the bank…but it would appear that the banks don’t quite see it this way!

There’s a number of reasons why loan rejections in this segment of the market have increased and to be honest, I’m making some assumptions here but I’m sure that granting home owners a 25-year loan when they are middle-aged and on the verge of retirement within 10-15 years is probably one of the reasons why the banks are conservative with these borrowers.

One thing is for sure – these statistics are quite staggering and there’s no question that this will have a major impact on the real estate market as we move forward.

I’m trying to find/obtain a breakdown of the ‘state by state’ numbers as I’m guessing that the number of loans rejected is far higher in Sydney and Melbourne than what it may be for other parts of the country.

At this stage, I haven’t been able to obtain these figures, but I’ll share them if I do receive them.

And now for some positive news – we’re still selling plenty of homes right now and my team is currently negotiating offers on 7 different properties right now…and that’s on top of the 5 sales we’ve made within the past week, so buyers are still out there, still purchasing and still paying top prices!

With less than 4 weeks until Christmas, we anticipate that the market will be really busy this December based upon the inquiry levels we’re experiencing right now.

Until next week, Happy Listing & Happy Selling!