The Perfect Storm That’s Fuelling The Rental Crisis, On Track For Christmas & Forty-Three Suburbs

As the year progresses, there’s one aspect of real estate that is becoming increasingly dire as the weeks roll on…the increasing shortage of rental properties.

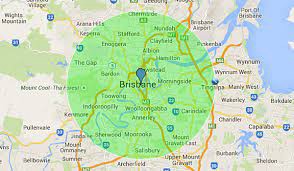

I’ve spent some time checking out the availability of rental properties right across the entire North side of Brisbane and to be honest, I cannot believe the prices that many properties are now achieving.

Yesterday, a client of mine told me that they enquired on a rental property whilst they are building their new home and at first, the property was listed for rent without a price.

They were horrified to find that the landlord is asking for $2600 per week.

Now this is a wonderfully modern home that’s quite large and situated in a lovely position backing onto the nature reserve, but it does reside on a standard sized block.

When my client told me this, I was wondering if he was confused and the asking price was actually $2600 per month but alas – it’s now advertised at $2600 per week.

Needless to say, that price is (in my opinion) completely off the charts.

But this isn’t the only one – without question, I can honestly say that I’ve seen prices rise by 20% in the last few months alone, let alone the price rises we saw leading up to this point.

These sorts of figures are certainly higher than a mortgage on the same sort of property so the question begs…How can the average family afford this?

With rapidly rising costs of living (in terms of groceries, petrol, electricity, gas etc), the family budget must be stretched for many of the people that are signing a new lease.

Diligent Property Managers should be looking at the budget of any potential tenant and the general rule of thumb is that the weekly rent should not exceed 40% of the applicant’s net wage.

Our Property Managers tell me that there’s a new trend of single parent families now combining their lives and moving in together in order to afford the hefty amounts that are required to secure a property.

The current vacancy rate in Brisbane stands at a measly 0.1%…and just to put this into perspective, this means that only 1 in 1000 rental properties remain vacant at present.

So, what’s the answer to solve this problem?

It’s certainly a complex issue and there’s no easy solution.

The ‘Greens’ political party believe that freezing weekly rental amounts for the next 2 years is the answer and this was one of their policies leading into the last Federal Election.

I don’t believe that this is a viable solution as the increased costs of Council rates, maintenance and of course, Interest rates mean that a landlord would be losing more and more money every month – this would surely detract more budding investors from buying an investment property and would only fuel the crisis further.

But kudos to the ‘Greens’ for at least offering some sort of solution.

The issue is a political ‘hand grenade’ with the current Government blaming the previous Government on getting to this point whilst the Opposition firmly criticising the current Government for taking little action towards finding a solution.

There’s a strong train of thought that the problem will only intensify once the full effect of increasing immigration numbers take affect…the solution required to fulfill the serious labour shortage that Australia is experiencing right now.

As we know, the Labour party offered a solution whereby the Government would effectively take an equity share in a property purchased by a First Home Buyer but as I shared with you earlier in the year, this policy seemed somewhat ‘haphazard’ and left more questions than answers…questions relating to the upkeep and maintenance on the property, the costs of selling (of course, these costs won’t be shared) and any renovations undertaken would need to be paid by the owner but effectively would benefit the Government if they held a 20% share of the property.

The solution offered by the previous Government was not exactly ideal either…an interest free loan to eliminate the costs of the Mortgage Insurance but this offering was also only limited to First Home Buyers and additionally, only available to a limited number of applicants.

Another issue is that the property boom has meant that many new developments are simply too risky for property developers given the costs of purchasing suitable land…and then you add in the issues of a lack of building materials (and as a result, the exorbitant costs of buying them), a shortage of tradespeople (and as a result, the money they’re now commanding to secure them) and to top it off, rapidly rising interest rates – you can see that this market is an absolute minefield for any property developer right now.

And to make things even worse for property developers, you have the ‘red tape’ that local Councils apply and the general public’s apathy towards cutting down trees and approving any large-scale developments.

I understand the environmental and ecological issues surrounding property development, but I’ve found that the very people that are opposed to development tend to be the same people that are complaining that rentals are unaffordable, and you can’t have it both ways.

The Queensland State Government recently ran a ‘Housing Summit’ in order to address these issues but I’ve yet to see any meaningful solution being offered – the only solution they seemed to concoct was some amendments in legislation to renting out Granny flats but what they fail to understand is that most ‘Granny flats’ are not Council approved and as such, do not fall under this category.

You could argue that the State Government has done their bit by pledging “$1 billion to the Queensland housing fund investment for social and community housing, fast tracking approvals for emergency housing after natural disasters” but questions beg about when we are going to see the results of this investment and how (exactly) are they planning on using this money – there’s still on-going discussions and submissions sought in relation to this report so it all seems very slow and tedious.

The only feasible solution I can see (which is highly unlikely to happen) is that the Federal Government will work with local Councils to fast-track the approval process and fund the entire cost of property development themselves.

They’ll then lease every property they own upon completion and as time progresses, they may choose to ‘sell off’ properties which would in turn, assist with the issue of affordability.

Of course, this isn’t the perfect solution either as the shortage of tradespeople and building supplies is still an issue…and the Government is ill-equipped to deal with the complexities of property development although suitable candidates to oversee this sort of operation could surely be employed on a contract basis.

But it’s certainly a vicious cycle – rising interest rates, a recent property boom, a record low vacancy rates, record low unemployment rates and shortages of building materials…all this on top of the trade issues with China and the War in the Ukraine.

One thing is for sure…this issue won’t resolve itself in the near future unless the Governments (State or Federal) take significant steps toward a workable solution very quickly.

Until next week…. Happy Listing & Happy Selling.

Feature Property Of The Week

This week’s feature property is 45 Tarnook Drive, Ferny Hills – This lovely abode is the perfect starter if you’re wanting to live in the leafy suburb of Ferny Hills. Offering 3 bedrooms, a lovely light-filled living and dining that encompasses cross-flow breezes from front to back, a gorgeous renovated kitchen, a huge rear deck and a generous 607m2 block with double side access and ample yard space at the rear, this affordable home offers plenty of potential to add value and grow. Already with substantial interest, be quick if you’d like to inspect before it’s snapped up by an astute buyer.

Superb Family Residence On A Generous 607m2 With Gorgeous Renovations

Insights Article…

As Michael has shared in his blog today, the serious shortage of rental properties and associated affordability of rental properties is the main topic in the media right now. Here’s a recent news story that explains more on why the crisis may deepen before it improves…

Click Here To Read Article

Did You Know?

Michael’s kids may not all be together for another 3-4 weeks so last Sunday, they set up the family Christmas tree. Very early for Michael who often doesn’t have it set up until mid-December. Michael says he’s even completed almost half of his Christmas shopping this year…not bad for someone that is synonymous with starting at the ‘Midnight’ shops the week leading into Christmas.

‘The Michael Spillane Team’ has sold properties in 43 different suburbs within the past 12 months alone – that’s a record for us in a calendar year.